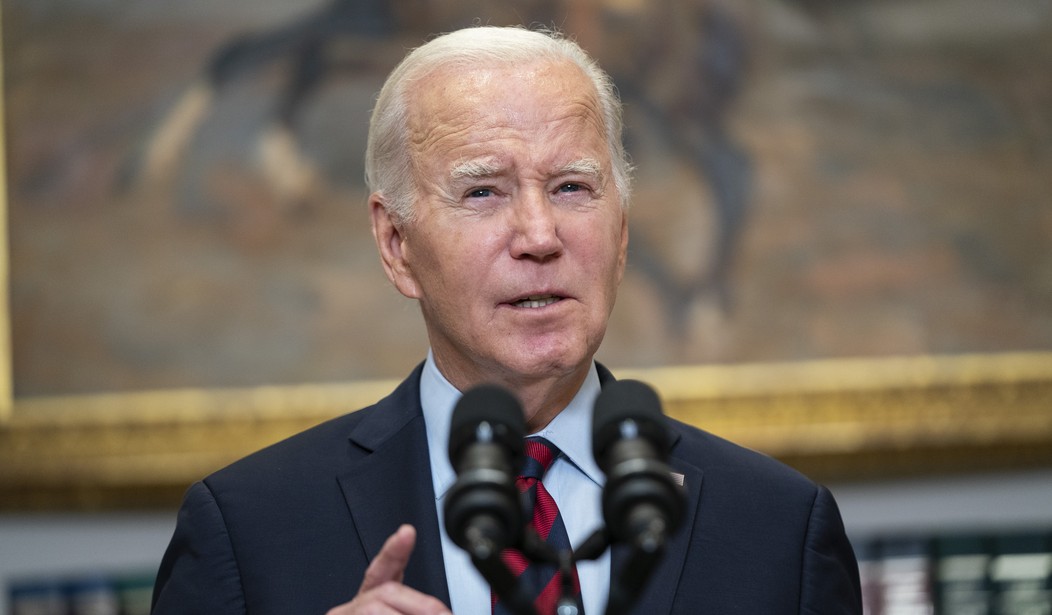

A federal appeals court ruled to lift an injunction on President Biden's student loan forgiveness plan, resuming the next phase of his initiative.

Federal judges in Massachusetts and Kansas issued temporary injunctions on Biden’s Saving on a Valuable Education (SAVE) plan on June 24. The 10th Circuit U.S. Court of Appeals lifted the injunctions on July 1. Although the court ruling is a “win” for the Biden Administration, an otherwise ruling would not have stopped the administration from canceling more student loan debt. Biden has a history of going against the court and spending money on the SAVE plan.

I seem to recall Biden breaking about openly ignoring SCOTUS about student loan forgiveness.

— Beach City Cop (@VBStrong_67) July 2, 2024

Ah yes, here it is https://t.co/6xveKzUCNu pic.twitter.com/RHdqttGqLe

In late June, U.S. District Judge John A. Ross in Missouri blocked the SAVE plan from giving more loan forgiveness, and U.S. District Judge Daniel D. Crabtree in Kansas placed an injunction on the "next phase" of the SAVE plan, scheduled to take effect on July 1. In the "next phase", payments for undergraduate loans were scheduled to be cut in half, dropping from 10 percent of discretionary income to five percent, CBS reported.

Breaking News: Biden spent $167 Billion on student loan forgiveness since the Supreme Court ruled it unconstitutional.

— Wendy Patterson (@wendyp4545) June 25, 2024

Their plan is to forgive $430 Billion without the approval from Congress and after the Supreme Court told the administration NO.

A federal Judge just blocked… pic.twitter.com/0LWbxl40PP

The federal appeal court ruling on July 1 lifted Judge Crabtree's injunction, making it easier for the Biden administration to spend money on student loan forgiveness. The administration has since placed some borrowers in “forbearance” until legal “issues” are settled, according to The Hill.

Despite what the Biden administration might claim, however, the injunction placed on the SAVE plan would not have made it "harder" for the administration to forgive student loans. When the two federal courts issued temporary restrictions on the SAVE program, the administration placed over three million student loan borrowers in a "payment pause."

Recommended

🚨🚨🚨 BREAKING: Biden administration to place over 3 million student loan borrowers in a 'payment pause' under 'Save Plan', borrowers would not need to make payments and interest would not accrue.

— 🇺🇸 Freedom Piper 🇺🇸 (@FreeThinkerInc) June 29, 2024

The announcement comes after courts in Kansas and Missouri both ruled against the… pic.twitter.com/hGpcucK4qN

In October 2023, CNN also reported Biden's administration "found ways" to cancel more than "$48 billion in debt" since the "Supreme Court struck down" Biden's student loan forgiveness plan in late June.

Overall, the Biden administration has repeatedly challenged court rulings, and the recent federal court appeal was no real feat.

Join the conversation as a VIP Member