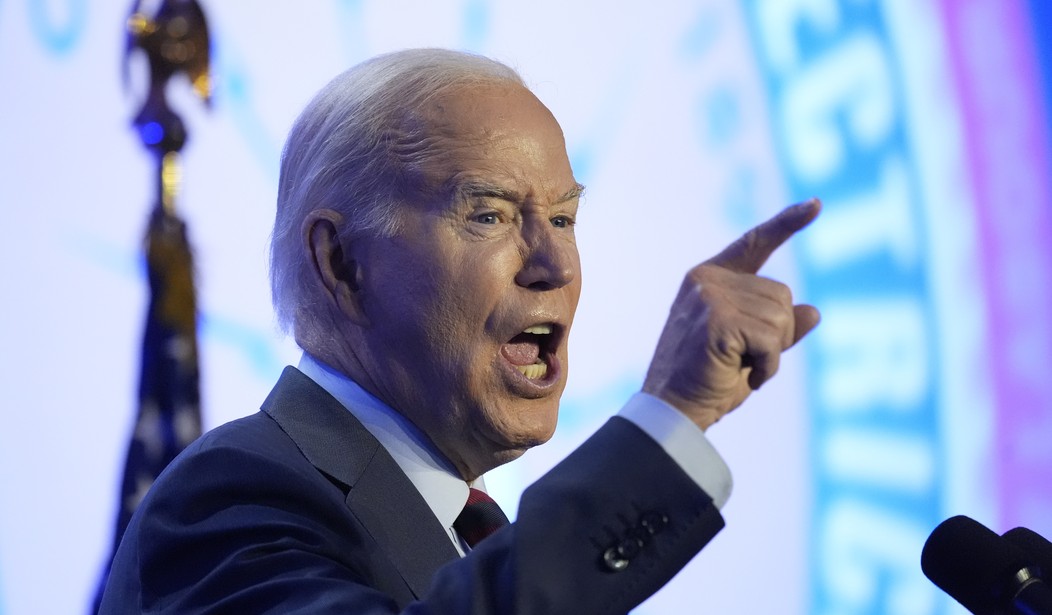

When he was running for president in the 2020 cycle, Joe Biden promised that he'd never raise taxes on anyone making less than $400,000 per year. Based on his own announced policies, however, this pledge was an unachievable lie from the very start. He's proceeded to repeatedly violate the vow, through various actions and proposals, during his term in office. One recent reminder of this broken promise comes to us via the Internal Revenue Service. You may recall that during the debate over Biden's "Inflation Reduction Act" -- which Bernie Sanders admitted was not about reducing inflation, and Biden later said he regretted the title of the bill -- Republicans warned that the legislation would super-charge and super-size the IRS. They also warned that a result of this would be a lot of tax-related targeting of non-rich Americans, who'd bear a substantial brunt of a doubled IRS.

Democrats pooh-poohed this concern, but when Republicans forced a vote to explicitly prevent the agency from auditing more American household earning under $400,000 per year as a result of the law, State Democrats unanimously killed it at the behest of party leadership and the White House. And guess what happened next? Exactly what conservatives said would happen. And now there's even more evidence proving us right:

The Internal Revenue Service got an audit of its own in time for Tax Day, and two irregularities jump out. President Biden’s plan to hire a new army of tax collectors is falling flat, and the agents already at work are targeting the middle class. Those are two findings of the IRS’s watchdog, the Treasury Inspector General for Tax Administration (Tigta). The report examines IRS progress on mandates from the Biden Administration backed by tens of billions in new funding. The first supposed goal was to audit more ultrawealthy and fewer middle-class filers, but it’s not going so well...The most recent data suggests the IRS is still focused on the middle class. As of last summer, 63% of new audits targeted taxpayers with income of less than $200,000. Only a small overall share reached the very highest earners, while 80% of audits covered filers earning less than $1 million. Don’t forget to save those charitable-giving receipts.

Nearly two-thirds of IRS audits were hitting individuals and families that were earning less than half of Biden's magic number. No one should be surprised. Now Biden has formally announced that he's going to impose a major tax increase on legions of non-rich Americans who earn well under $400,000 (though even many of those earners are complaining that they aren't really wealthy, given Bidenflation, the high cost of living etc). Democrats have lied endlessly about the 2017 Trump/GOP tax cuts and reforms, which helped turbocharge the US economy, resulting in record-high revenues and record-setting employment. They falsely claimed that the law was a giveaway to the rich that didn't help ordinary Americans. In fact, every single income group benefited, as did the overall economy. It's not a coincidence that Trump and Republicans are heavily favored by voters on economic matters. Further underscoring the Democrats' dishonesty, letting the Trump tax cuts expire, which Biden says he wants, would massively hike taxes on working and middle class Americans:

Donald Trump was very proud of his $2 trillion tax cut that overwhelmingly benefited the wealthy and biggest corporations and exploded the federal debt.

— Joe Biden (@JoeBiden) April 23, 2024

That tax cut is going to expire.

If I’m reelected, it’s going to stay expired.

🚨 A big deal: Amid painful inflation that he made worse, Biden endorses tax hikes on non-rich American taxpayers and families https://t.co/u17hhwbEIC

— Guy Benson (@guypbenson) April 24, 2024

Budget expert Brian Riedl of the Manhattan Institute explains how calling for the tax cuts to expire would result in a $2 trillion tax increase for many millions of non-rich Americans, in addition to clawing back the child tax credit. The White House, with its mendacious and incoherent messaging is trying to have it all ways -- playing dishonest politics, as usual:

The White House wants it every way on the TCJA:

— Brian Riedl 🧀 🇺🇦 (@Brian_Riedl) April 24, 2024

1) They demand to end the "Trump tax cuts" - and write a budget claiming all the deficit savings from full expiration, but then also:

2) Pledge to extend for the bottom 98%, which costs $2 trillion over the decade.

Which is it?

This is clumsy sleight of hand, claiming "deficit savings" as if all the tax cuts are going away (letting people keep more of the money they earn isn't 'government spending' in my view, as the government doesn't own those dollars), but separately talk about renewing 98 percent of the tax cuts in order to avoid huge tax increases on the very people they've pretended never benefitted from the Trump/GOP law. And then Biden's team goes out and tweets under his name that they're axing the whole tax cut, further confusing matters. Biden is lying about deficits and debt (which he does all the time), and/or lying about who benefited from the tax reforms he's demagogued and intentionally mischaracterized, and/or planning to slap basically the whole country with a gigantic tax increase, on top of the 19 percent price hike his inflation crisis has fueled since he took office. Tired of this yet?