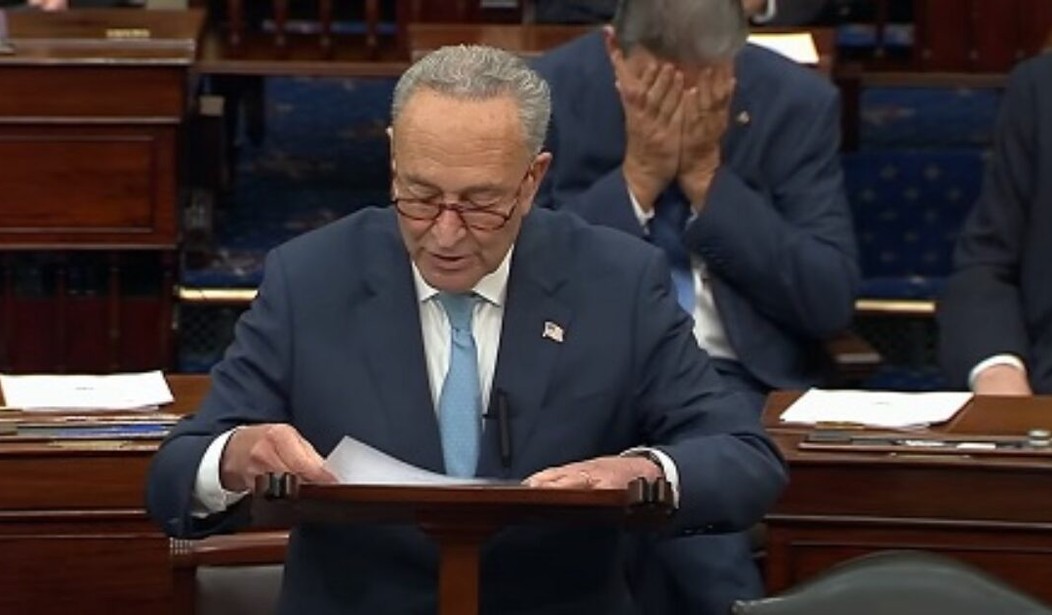

The dust is still settling from the surprise announcement of a huge tax-and-spent deal forged between Joe Manchin and Chuck Schumer late last week. Below, the editors of the Wall Street Journal argue that Democrats may want to rush the package to a vote as soon as possible because "the more Americans learn what’s in this tax-and-spend behemoth, the more they’ll dislike it." As I mentioned in my piece-by-piece analysis of Manchin's Fox interview about the legislation, senior Republicans I've spoken to believe that despite the Beltway hoopla around the apparent breakthrough, the attacks they're prepared to run against Democrats who support it are potent. We touched on several of those central criticisms yesterday, and the Journal editors are homing in on one in particular:

Evidence is emerging that the new Schumer-Manchin 15% minimum tax on corporate-book income is especially harmful to U.S. manufacturing firms. An analysis by Congress’s Joint Committee on Taxation (JCT), which is hardly a nest of supply-siders, found that 49.7% of the tax would hit U.S. manufacturers... One well-known economic truth is that corporations don’t really pay taxes. They are essentially tax collectors, as the corporate tax rate ultimately falls on some combination of workers, shareholders and customers. Raise the corporate tax rate, and you’re cutting wages and salaries for workers. No surprise, that’s exactly what the Joint Committee on Taxation found in its analysis of the Schumer-Manchin bill’s distributional impact. The JCT finds that average tax rates will increase for nearly every income category in 2023 under the bill. Taxes will rise by $16.7 billion in 2023 on Americans earning less than $200,000 a year. Taxpayers earning between $200,000 and $500,000 will pay $14.1 billion more. This gives the lie to Democratic claims that no one earning under $400,000 will pay more taxes under the bill, a promise Mr. Biden also made in his campaign. The reality is that the Schumer-Manchin bill is a tax increase on nearly every American.

Biden has sworn up and down that under his administration, nobody earning less than $400,000 annually would see any tax increase. That was demonstrably false when he first started issuing that pledge, based on his own stated plans, and it's been proven false several times during his presidency. This is just another betrayal of his poll-tested claim, designed to bamboozle non-rich taxpayers into thinking they'd be safe from Democrats' rapacious appetite for more government revenues. I'm not sure what is more shameless -- Biden repeating his debunked and violated tax lie ad nauseam, or Manchin claiming that the new bill doesn't raise taxes at all. It does, of course, by hundreds of billions of dollars. No one was disputing that until Manchin made his novel argument over the weekend. Speaking of shameless, National Review's editorial board addressed the Biden/media/'fact checker' spin that two consecutive quarters of economic contraction does not really count as a recession:

Recommended

It is almost comical how much work the Biden administration is putting into denying that the U.S. economy has entered a recession. Here is what is not in dispute: One, real GDP is contracting and appears to have been for half a year now. Two consecutive quarters of GDP contraction is the commonly accepted definition of a recession when there is a Republican incumbent facing reelection; when Democrats are in danger of a midterm wipeout, “recession” becomes a term of art. The Biden administration has really been trying to work the National Bureau of Economic Research, who are the guys who will decide whether to call the recession a recession...Two, the labor market isn’t actually strong. If the labor market were strong, then real wages would be going up, and the number of jobs would have recovered to its pre-Covid level. Neither of those things has happened. In fact, real wages are going down, not up. Which is to say, Americans are working more hours for less pay — hardly the sign of a good jobs market...Is it a recession or not? Whatever the NBER calls it, it’s 9.1 percent inflation, declining real incomes, and declining economic output.

For a deeper dive into the state of the US economy, and a review of "recession" talk, and indicators of what might be coming down the pike, listen to this discussion with Fox Business Network's Dagen McDowell. In short, things are bad right now, and some indicators suggest more pain is on the way -- possibly for quite some time:

.@dagenmcdowell torches Biden's economy

— The Guy Benson Show (@GuyBensonShow) August 1, 2022

"They've created a world of suckatude it is a black hole of idiocy in Washington." #FoxNews #FoxBusiness #Biden https://t.co/0F9iwiXsj8

With inflation at the forefront of Americans' minds, we've noted that a Wharton study -- which Joe Manchin has claimed to monitor closely and take very seriously -- determined that Democrats' new legislation would probably slightly increase inflation in the near term, then have negligible impact on the phenomenon in the longer term. Calling this thing the "Inflation Reduction Act" is ludicrous, as Nancy Pelosi inadvertently illustrated last week:

Nancy Pelosi on Democrats' new tax hike legislation:

— RNC Research (@RNCResearch) July 29, 2022

"Transformational. We've never spent this much money." pic.twitter.com/qS56jlF3QX

When you're bragging about the "transformational" and unprecedented scope of new government spending, you're not really helping the whole 'fighting inflation' talking point. I'll leave you with this data point, which could suggest voters may not be inclined to buy Democrats' audacious branding of a tax-and-spend bill as an anti-inflation measure:

CBS NEWS BATTLEGROUND TRACKER: Republicans are leading among those who say inflation is "very important" in their vote, as well as those feeling "a lot" of impact from higher food and gas prices. pic.twitter.com/1O6go7og2v

— InteractivePolls (@IAPolls2022) July 31, 2022

Join the conversation as a VIP Member