Nobody likes paying fees. A fee, however, is a transparent way to reflect the price of something. In a market economy, prices convey vital information that consumers and producers use to make good decisions. A rise in the price of apples tells producers that consumers want more apples. This prompts more apple production (and, eventually, lower prices). And so, when political interference keeps prices from fluctuating freely, the result is inefficiency and waste.

The Consumer Financial Protection Bureau (CFPB), calling the prices of bank overdraft protection "junk fees," now proposes to interfere with these prices.

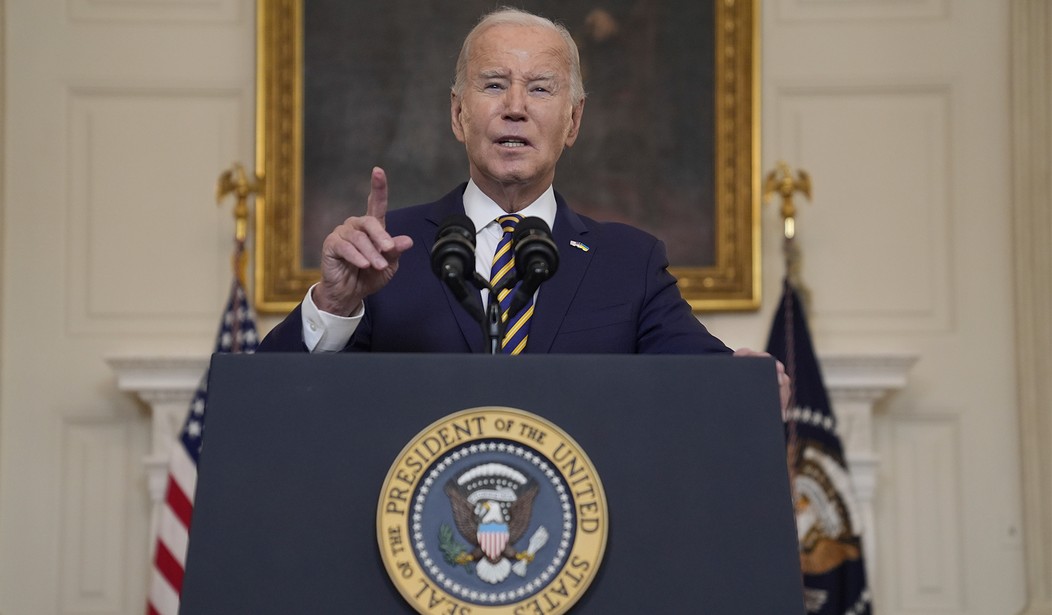

We've been down this road before. Last year, the CFPB proposed capping credit card late fees at $8 as part of President Joe Biden's populist appeal to consumers who dislike this cost, which is obviously everyone. The problem, as I and many others explained at the time, the problem is that late fees encourage timely payment, and their practical elimination leaves lenders unable to offset the risk of working with people with lower credit.

The result will be fewer lines of credit available to those who need credit the most. But that's a difficult outcome for most to see compared to the tangible benefit of lowering fees. Even consumers denied credit won't know what or who to blame, so it's no surprise that CFPB is expected to finalize the late fee rule any day now.

The next CFPB price-control scheme would cap overdraft fees at levels as low as $3 per overdraft transaction. Commenting on this rule, Biden sounded perfectly populist: "For too long, some banks have charged exorbitant overdraft fees -- sometimes $30 or more -- that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines." He added, "Banks call it a service -- I call it exploitation."

Recommended

I get it. I remember the annoyance I felt when I was charged such fees. However, I reminded myself that it was the price to pay for not having one of my checks bounce or a debit card payment declined. It's fair to wonder whether most of the people proposing these rules have ever had a checking account balance low enough to need the overdraft cushion.

In fact, overdraft protection is an optional, opt-in service that allows consumers to spend money they don't have at the bank's expense. Purchases are approved that would otherwise be declined for lack of funds. For low-income consumers, this service is sometimes vital. Indeed, consumers report by wide margins that they are glad it exists even though it naturally comes at a cost.

Thankfully for all of us, CFPB bureaucrats agree that banks should charge a fee. Unfortunately, they think they know best what these fees should be. They think they know the exact costs of honoring charges for customers with negative balances better than banks. And remember, because banking is competitive, any bank that charges excessive overdraft fees will lose customers to banks that don't. That $30 fee per overdraft transaction is the price that emerged among the competitive forces that keep prices lower than they could be.

Because of bureaucratic interference, many who see overdraft protection as preferable to other short-term credit options, such as payday lending or high credit card balances, will have fewer choices as some banks decide that the service isn't worth offering at the price deemed appropriate by government officials.

Banks might go even further. Given the slim profit margins they earn on small bank accounts, it's possible that the loss of overdraft protection revenue results in some simply abandoning the very customers -- the least well-off -- whom interventionists claim to be protecting.

This frequent political problem -- failing to consider how policy interventions alter incentives in ways that produce bad outcomes -- extends well beyond the realm of finance. For instance, the United States education system is collapsing partly because school boards across the country have decided that graduation rates are the most important metric to track success and are now frequently used to determine funding. So, school administrators responded by boosting graduation rates in the simplest and most obvious manner: by making it all but impossible for students to fail. Students, in turn, have largely stopped trying. Graduation rates are up, but learning is down.

Politicians and bureaucrats appear not to be learning much, either. When planners make ham-fisted attempts to alter complex systems or intervene in markets, results rarely match their expectations.

Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate Web page at www.creators.com.

Join the conversation as a VIP Member