Professor James Hop and Ohio State senators George Lang and Bill Reineke co-authored this article.

For months, we have been concerned with the direction of the US economy and its negative impact on the growth of state economies, especially Ohio; the following are why.

1. Trucking Recession

The US trucking industry, crucial during COVID-19 for delivering essentials, is now in recession or worse, posing risks for the economy of 2025 and beyond. In his recent newsletter, noted trucking expert Jack Porter highlighted severe revenue struggles, with carriers losing 50% of their gross profit due to increased variable costs and pressures to lower rates. According to the US Bureau of Economic Analysis (BEA), the trucking industry supports approximately 15% of the US GDP and now, unfortunately, faces looming bankruptcy according to our analysis. Porter recently noted the American Trucking industry has not faced conditions as bad as today in his 40-plus years as an industry analyst.

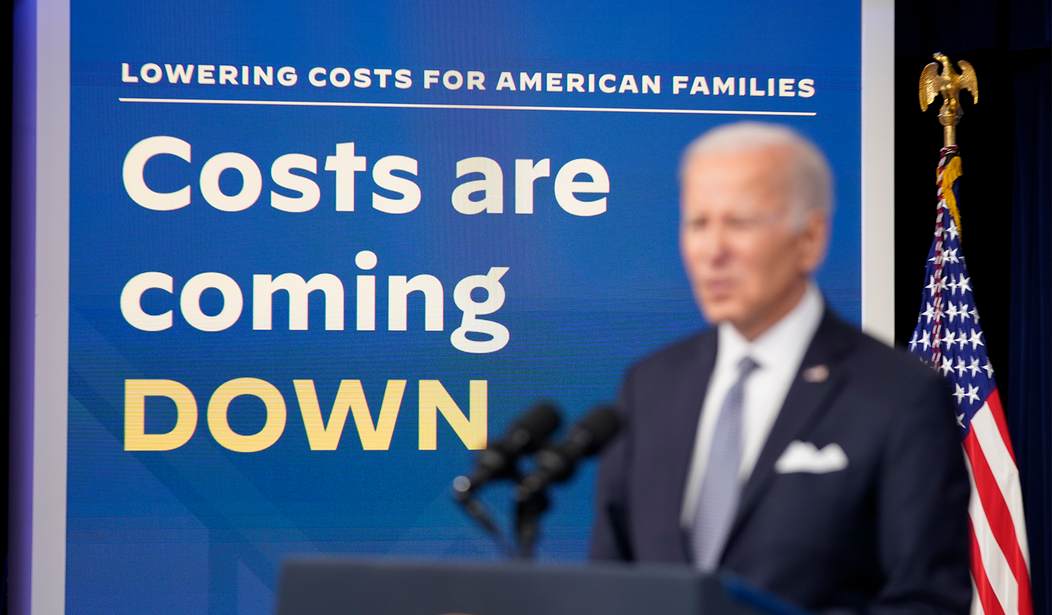

2. Inflation

From January 2021 through July 2024, overall inflation during the first 42 months of the Biden Administration grew at 19.59%, averaging 5.6% annually, according to the Bureau of Labor Statistics CPI Calculator. During the four years of the Trump Administration, overall inflation was 7.38%, averaging 1.85% annually, below the Federal Reserve's annual target of 2%. It is important to remember inflation still increased at an annual pace of 2.9% in July; it will take years for the lingering impact of 9.1% inflation during the summer of 2022 to dissipate in our economy. For example, according to Bankrate, the 30-year fixed mortgage interest rate realized an all-time low of 2.65% in January 2021. Today, the same rate is 6.53%.

3. Key Stock Indices

Recommended

The Russell 2000 Index, tracking 2,000 of America’s prominent, publicly traded small-cap stocks, grew 59.83% during the Trump Administration but only 1.96% during the first 43 months of the Biden/Harris Administration. And, when adjusted for inflation, the Russell 2000 is down more than 18% under Biden/Harris. The Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ had significantly better growth under President Trump (DJIA = +57.3%, S&P 500 = +69.6%, NASDAQ = +42.2%) compared to President Biden (DJIA = +32.26%, S&P 500 = +46.05%, NASDAQ = +31.93%). With many people surprised by the above stock market performance, it is perhaps a good idea to reference Daniel Patrick Moynihan's famous words, “You are entitled to your opinion. But you are not entitled to your own facts.”

4. Used Car Prices

Alan Greenspan, former US Federal Reserve Chairman, asserted that falling used car prices are a strong indicator of a slowing economy, potentially leading to a recession or depression, especially during periods of high inflation.

According to the US Bureau of Labor Statistics (BLS), used car prices fell again in July 2024, dropping almost 20% from their post-pandemic highs, while new vehicle prices decreased by 1%. The price declines resulted from a build-up in new and used vehicle inventories. As of August 1st, the total new vehicle inventory on dealer and factory lots was 2.79 million units, up from 2.77 million units in April. Industry consultant Cox Automotive predicts that the new car inventory will reach 3 million units by the end of 2024 (three times the level during the chip shortage). The new vehicle inventory on dealer lots was 68 days at the start of August, which improved by 10.5% from April. Dealer inventory, which measures the number of days new vehicles sit on a dealer’s lot before being sold, is still up 23.6% from May 2023.

5. Declining GDP

The 2023 US economy grew at an annualized rate of 4.9% in Q3, slowed to a growth rate of 3.4% in Q4, and dropped to 1.4% in Q1 2024. The initial estimate for Q2 2024 showed a rebound in GDP growth to 2.8% or an average quarterly growth rate for the first half of 2024 of only 2.1%. Economists are concerned about GDP growth for the rest of 2024 due to high interest rates and declining private investment.

6. Increasing Unemployment

The US unemployment rate rose from 3.4% in April 2023 to 4.0% in May 2024, according to the BLS. Unfortunately, 2024, US unemployment continued to rise, reaching 4.1% in June and 4.3% in July, nearly 1% above the April 2023 rate of 3.4%. The Sahm Rule, which signals a recession when the three-month moving average of the unemployment rate increases by .5% or more above its 12-month low, historically signals a recession has begun. The Sahm Rule has accurately predicted the start of every recession since 1970.

7. Small Business Optimism

The NFIB's Small Business Optimism Index has been below its 50-year average of 98 for the past 31 months, coming in at 93.7 in July. Small business owners' primary concern is inflation and its impact on consumers. The prolonged period of below-average optimism indicates ongoing challenges and uncertainty for small businesses in America.

8. Skyrocketing Regulations

A study released in April by the American Action Forum, based on federal government data, found that regulations cost the US economy significantly more under President Biden, rising by over $1.37 trillion. In contrast, the regulatory burden on the US economy increased by only $30 billion during President Trump's tenure and $303 billion during the eight years of the Obama Administration. The energy and manufacturing sectors are among the most adversely affected by the increased regulatory burden under President Biden.

Conclusion

According to the US Treasury Department, the US national debt increased from 30% of GDP in 1981 to over 123.2% of GDP today. We are experiencing an untenable trend that cannot continue. Put another way: America in 2024 is almost as financially burdened as a percent of GDP as it was at the end of World War II. To analyze this problem more personally, the total dollar US-national debt grew from less than $1 trillion in 1980 to more than $35.26 trillion today, or $39.05 trillion if you include US state and local debt. The average American taxpayer now carries a total US government debt burden of $284,000, in addition to personal debt, to cover their share of total US government debt. To reverse the above conditions and maintain our position as the world’s largest, most respected, and most prosperous economy, Americans must vote for lower taxes, less government, balanced federal budgets, and a regulatory environment promoting entrepreneurship and the American Dream…nothing less can be acceptable.*

*This article is based on the collective research and preparation for separate talks over the last three months in places ranging from Columbus, Ohio (the Ohio legislature small business caucus) and Cleveland, Ohio (the Cleveland partnership small business caucus) to Midland, Michigan (Midwest legislators forum at the McNair Center, Northwood University) and Denver, Colorado (51st annual meeting of the American Legislative Exchange Council – ALEC).

Dr. Timothy G. Nash is director of the McNair Center at Northwood University. Senator George F. Lang is a Republican State Senator from Ohio’s 4th District. Senator William F. Reineke is a Republican State Senator from Ohio’s 26th District. Professor James Hop is chair of the Entrepreneurship Department and a McNair Scholar at Northwood University.

Join the conversation as a VIP Member