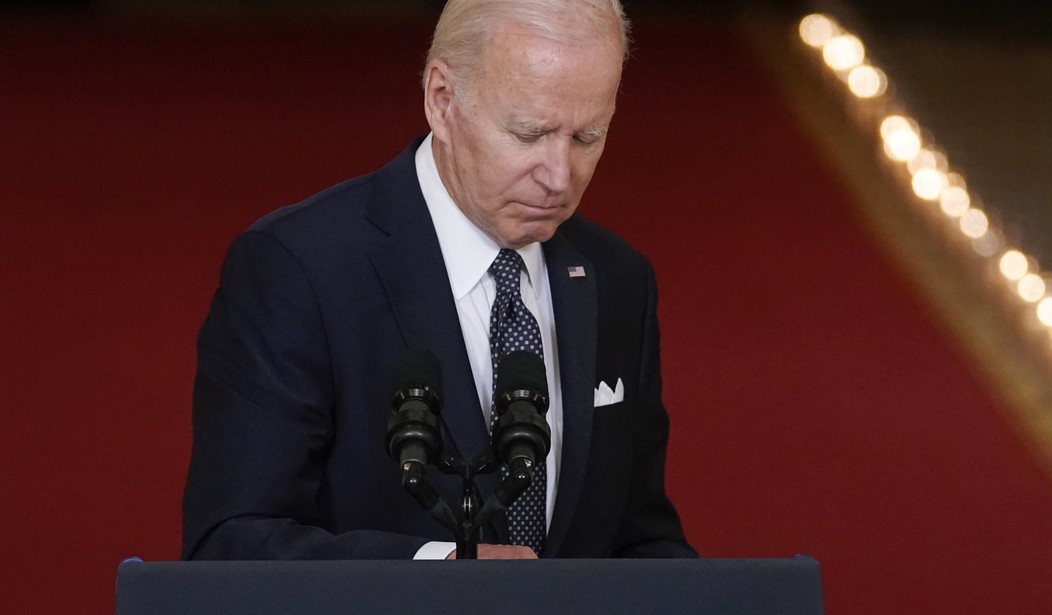

America has a severe inflation problem. We feel it every time we go to the grocery store, or a restaurant, renew an apartment lease or fill up our car—our paychecks are not keeping up with prices. This in turn has caused severe political problems for President Biden. Indeed, the only thing eroding faster than our purchasing power may be his political capital.

While there are undoubtedly genuine supply chain challenges, much of this problem was self-inflicted. Biden’s $1.9 trillion spending binge passed under the heading of COVID relief was simply too big, and the San Francisco Federal Reserve estimates fiscal stimulus has caused half of our inflation overshoot or about 3%. His rhetoric has had a chilling impact on the oil and gas sector, restraining production, with Chevron’s CEO doubting we will ever build another refinery given the governmental push away from fossil fuels. On problems like baby formula, the Administration has been haplessly flat-footed.

However, in their mad scramble to show they are taking on inflation before the midterms, it seems like Biden is about to compound his error with rising speculation he will remove Trump’s tariffs on Communist China, which would be a cataclysmic error.

These tariffs on Chinese imports generate over $50 billion in revenue and serve important geopolitical goals, which would be destroyed by capitulation. Importantly, they are not driving inflation—since the start of 2017 Chinese import prices have lagged global imported goods prices by 9% reflecting Chinese firms having to reduce prices to pay for a portion of the tariff. From the start of the Trump administration through the end of 2019 when the Phase One deal was agreed to consumer prices for core goods fell by 0.7%. Contrary to media speculation, the tariffs did not cause significant price increases; accordingly, their removal will not cause decreases, particularly in an environment where demand is outstripping supply.

Recommended

If we were to generously assume half of the lost tariff revenue is passed on to consumers via lower prices, the disinflationary impact would be 0.15%, a drop in the bucket compared to our inflation problem. To receive this modest relief, we would suffer a monumental strategic cost.

Authoritarian thugs like Putin and Xi respect only one thing: strength. We cannot know to what extent Biden’s botched Afghanistan withdrawal emboldened Putin’s invasion of Ukraine, but it likely played a role. To unilaterally disarm on tariffs when China has failed to meet virtually all of its Phase One purchasing agreements signals a degree of weakness that would even make Jimmy Carter blush.

Doing so at a time when Xi is actively supporting Putin’s war on Ukraine by purchasing more oil and refusing to participate in sanctions is entirely counterproductive. In our response to Putin, we have seen that the 21stcentury war is a legal, financial, and economic game as much as a military one.

Indeed, we have seen the difficulty with which Europe contemplates moving away from Russian oil and gas. Just as Europe depends on Russian fuel, we depend on Chinese goods. As Xi contemplates action against Taiwan, does removing tariffs now make him think we’d have the stomach to seriously sanction China if he invades? That display of weakness only makes the situation more dangerous.

In fact, the Xi-Putin partnership makes clearer the need to diversify our supply chains away from China. To do so, it is critical to signal these tariffs are permanent. Faced with the permanent cost of tariffs, American businesses may redirect investment elsewhere, but by opening the door to their removal, businesses will be inclined to “wait out” the tariff and retain their operations. Considering the geostrategic need to move production out of China to our own shores and to our allies so that China cannot weaponize its exports of goods like Russia has food and energy, tariff relief is a prime example of seeking an “easy win” that turns into a substantial loss.

Sometimes, when you are in a hole, it is best to just stop digging. Unfortunately, the Biden Administration seems intent on compounding its mistakes. Going tough on China did not cause our inflation problems; going soft won’t fix it. It will just show us as weak to another murderous dictator and leave our economy worse prepared to face the top geopolitical threat we face this century: the rise of China and its Axis of Authoritarians.

It may be a novel idea, but perhaps rather than try to make Chinese goods cheaper, President Biden should make it cheaper to make products in America—opening more federal lands for drilling at lower royalty rates, streamlining environmental reviews, and easing transportation regulations would be a good start.

Join the conversation as a VIP Member