Even small differences in economic growth make a big difference to living standards over time.

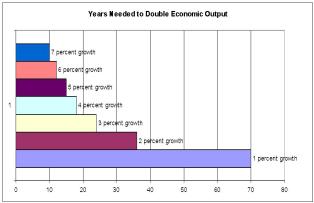

I frequently share this chart, which highlights how long it takes to double economic output based on different growth rates.

I also use real-world examples to show how some nations become much richer than other nations within just a few decades because of better policy and faster growth.

Here’s another way to approach the issue. Let’s use a hypothetical example to reinforce the importance of growth. If we went back to 1870 and assumed our economy’s nominal growth rate was one percentage point slower than it actually was (in other words, averaging 4.76 percent each year rather than 5.76 percent), our living standards today would be only 1/4th of current levels.

That’s a huge difference in national prosperity. We’d be about the level of Kazakhstan today!

Recommended

In a column for the Wall Street Journal last week, Louisiana Senator Bill Cassidy and businessman Louis Woodhill used the same approach to make a similar point about the incredible importance of long-run growth. They go back even further in time and come up with an even more sobering example.

The recovery that began in 2009 is the weakest in postwar history. Millions have dropped out the labor force, frustrated by lack of opportunity. Lower-income workers are underemployed, middle-incomes have not advanced as in the past, and government dependency has increased. …ignored is what really matters: rapid, sustained economic growth. The Congressional Budget Office has estimated that the U.S. economy will grow by a meager 2.3% over the next decade… At this growth rate, Americans face a future of stagnation, inequality and despair. Here’s why: From 1790 to 2014, U.S. GDP in real dollars grew at an average annual rate of 3.73%. Had America grown at the CBO’s “economic speed limit” of 2.3% for its entire history, GDP would be $780 billion today instead of more than $17 trillion. And GDP per capita would be $2,433, lower than Papua New Guinea’s.

This is why (good) economists are so fixated on economic growth. It’s vital for our long-run living standards.

Which means, of course, that we’re also fixated on the importance of free markets and small government. We understand that an economy will grow much faster if the burden of government is constrained (think Hong Kong or Singapore).

But if the public sector is bloated, with high levels of spending, taxation, regulation, cronyism, and protectionism, then it’s very difficult for the productive sector of the economy to flourish.

Let’s augment our understanding by comparing two nations, Estonia and Croatia, that emerged after the collapse of the Soviet Empire.

Estonia has been a role model for pro-growth reform. According to Economic Freedom of the World, the small Baltic nation quickly moved to reduce the burden of government (including a flat tax) and Estonia consistently has been in the top 20 of all nations.

Croatia, by contrast, has lagged. While its economic freedom score has improved, the progress has been modest and Croatia has never been ranked higher than #70.

So what are the real-world results of what happened in these two nations?

The simple answer is that good policy yields good results. Here’s a chart, based onIMF data, showing per-capita GDP in both Estonia and Croatia.

The most relevant lesson, which I highlighted, is that Croatia was much richer at the beginning of the post-Soviet period.

But Estonia quickly caught up because of its reforms. And over the past 10 years, Croatia has fallen significantly behind.

The key takeaway is that growth matters. And if you want growth, you need economic freedom.

Which brings us back to the aforementioned Wall Street Journal column. Cassidy and Woodhill are totally correct to worry about the “new normal” of anemic growth.

Fortunately, we know the policies that will rejuvenate the economy. And maybe we’ll get a chance to implement those policies after the 2016 election.