Here’s the secret banks in Indiana don’t want Hoosiers to know. Big banks discriminate. They do it all the time and they’re fighting hard to make sure that doesn’t change.

Banks have been openly discriminating against businesses they feel have fallen out of political favor. The firearm industry knows this all too well. This has been happening since the Obama administration, when then-U.S. Attorney General Eric Holder instituted Operation Choke Point. It was an illegal scheme contrived to use the muscle of the Federal Deposit Insurance Corporation, which backs banks’ assets with taxpayer funds, to force banks to deny banking services to disfavored industries.

Firearm businesses were put into that category. It was an attempt to undermine the Second Amendment and deny law-abiding citizens their ability to purchase firearms.

Those aren’t heartland values. Congress didn’t think so either and forced Obama and Holder to shut down Operation Choke Point. But the discriminatory practice didn’t go away, it just went private. Banks have been doing this on their own ever since. Citigroup, Bank of America, JP Morgan Chase and more recently, Wells Fargo – all corporate banks that command the vast majority of America’s wealth – of Indiana’s money – adopted policies to discriminate against gun makers, shun firearm retailers and crush businesses that refused to bow under their “woke” corporate virtues.

Recommended

They refused banking services to businesses that make America’s most-popular selling centerfire rifle on the market today – the AR-15 or modern sporting rifle (MSR). Banks said if businesses make them or sell them, they can’t access their financial services. They say this even while they gladly take Indiana taxpayers’ money to protect their corporate banks and after they gladly leaned on the American taxpayer for a $498 billion dollar “too big to fail” bail out in 2008.

Their memory is short, but their policies are far reaching. That’s why Congress and even the Office of the Comptroller of the Currency (OCC) got involved. U.S. Senator Kevin Cramer (R-N.D.) introduced the Freedom Financing Act, S. 821, which attempted to end this blatant discrimination. The OCC drafted a “Fair Access” banking rule that would ensure corporate banks made financial decisions based on creditworthiness instead of amorphous and ill-defined “reputational risk.” In other words, it would stop their unaccountable policymaking from faceless boardrooms that discriminate against lawful businesses solely because their politics fell out favor.

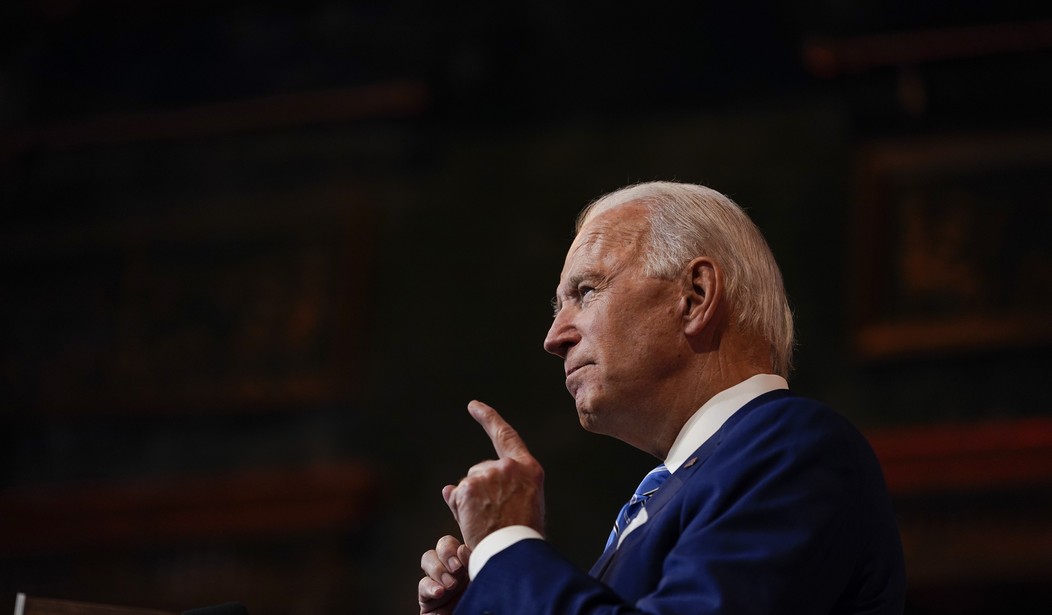

Big banks fought hard against those ideas. The proposed bill never moved in Congress and the OCC rule was shelved by the Biden administration, undoubtedly with a wink-and-a-nod to the big banks to continue their corporate discrimination against American rights.

Indiana has a chance to fight back. They can join other states that are taking a stand and saying enough is enough and high-rise ivory tower corporate boardrooms can’t get away with forcing illegal practices on Main Street businesses and supplant heartland values with cocktail party policies.

Indiana’s Senate Bill 49, introduced by state Senator Jim Tomes. It’s titled the Firearm Industry Nondiscrimination (FIND) Act would make it unlawful for financial institutions in the state to have policies of discrimination against the firearm industry. Indiana would be joining Georgia which already has this law and Arizona, Arkansas, Kansas, Kentucky, Louisiana, Missouri, South Carolina and Texas are working on similar anti-discriminatory measures. These are all states that are saying the same thing – that corporate intrusion on fundamental rights won’t stand. They are drawing the line and pushing back. In 2018, the Louisiana State Treasurer and state bond commission kept Citigroup Inc. and Bank of America out of state bond sales due to their discriminatory practices against the firearm industry.

Enough is enough. Corporate banks don’t get to dictate public policy by discriminating against lawful business because they don’t like their products.

According to industry surveys, nearly 75 percent of firearm industry members have been denied financial services solely because of their affiliation with the firearm industry. This discrimination isn’t limited to the firearm manufacturers. It extends to the mom-and-pop shop on the corner that is also teaching firearm safety courses, hunter safety and selling the firearms law-abiding citizens in Indiana want.

This bill is Indiana’s opportunity to stand up to corporate banks and reassert heartland values.

Lawrence G. Keane is the Senior Vice President and General Counsel for the National Shooting Sports Foundation, the firearm industry trade association.

Join the conversation as a VIP Member