California's $20/hour minimum wage for fast food workers went into effect this month, and the early results are negative. Companies affected by the law are laying off workers, putting off needed capital improvements, and raising prices. Some are closing their doors altogether or opening new restaurants only in other states. Keep in mind that these companies have already been dealing with post-COVID-lockdown business losses, homelessness, crime, retail theft, and loss of customers as people move out of the state's largest and most populous cities.

When I posted a critical Washington Examiner article on my Facebook page, a close friend remarked that he understood the objections, but that something needed to be done to address the problem of affordable housing for the working poor in California.

The sentiment "We have to do something" drives disastrous decisions. Sentiment doesn't sense. Feelings aren't facts. Loud protesting isn't logical. Politicians exploit voters when emotions run high. They get elected on facile promises to "solve" deeply entrenched problems. And then, when they enact policies that worsen those problems (and create others), they protest that their intentions were good.

That's not good enough.

Oregon's drug legalization law was another example of sentiment over sense. In 2020, a state ballot initiative decriminalized possession of small amounts of hard drugs, including heroin, fentanyl, cocaine, and methamphetamine. Proponents argued that stiff drug laws disproportionately affected minorities; nearly 60% of Oregonians voted in favor of the initiative. But between 2019 and 2022, opioid deaths in Oregon tripled. In March, the state's legislature passed a new law re-criminalizing possession of those drugs, which the governor signed last week.

History is replete with similar examples.

Closing so many of our mental health facilities sounded compassionate, and advocates insisted that they wanted the mentally ill to have "autonomy" and "dignity." But it's neither autonomous nor dignified to live in the streets, defecate and urinate on a public sidewalk, or pass out in a drug-addled stupor with your pants around your ankles.

Recommended

Nearly 50% of the nation's unsheltered homeless people live in California, and the numbers have increased dramatically (32% just in the past five years). The state spent $24 billion on programs to reduce homelessness between 2015 and 2020, but a recent audit revealed California neither tracked spending nor the impact of any programs.

But hey -- the politicians had good intentions. And we had to do something.

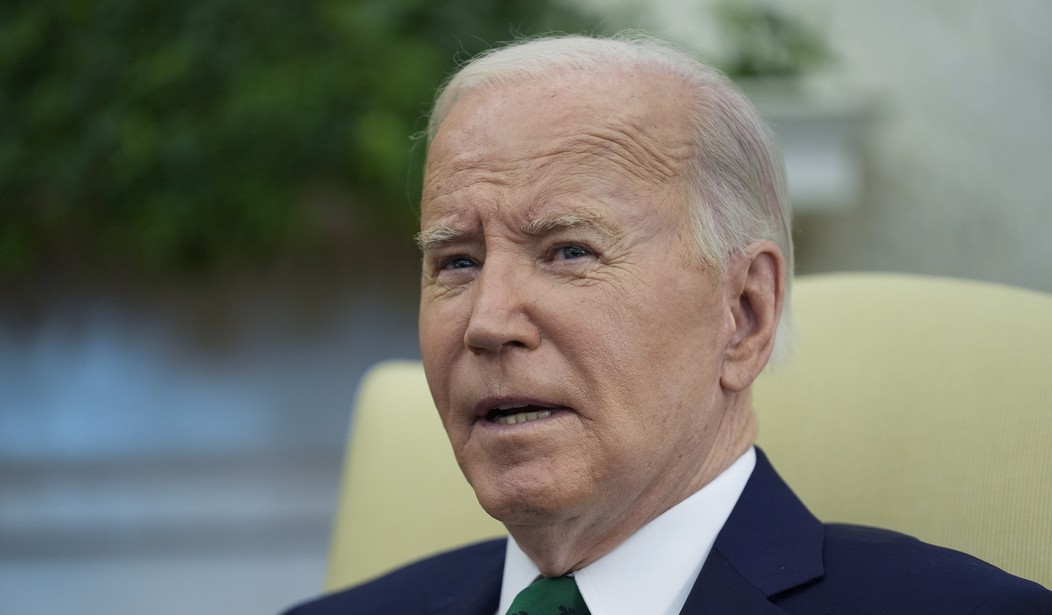

Now President Joe Biden is claiming (again) that he is going to "cancel" or "forgive" student debt. (His first attempt was struck down by the U.S. Supreme Court.) His efforts are not only unconstitutional usurpation of congressional authority and interference with contracts, they are lies. Perhaps worst of all, they exacerbate policies that caused the problem in the first place.

First, the lies.

Debts are actually forgiven every day, in negotiations between parties on private contracts. Debts are also actually canceled by bankruptcy courts, which decide that certain creditors of insolvent debtors will be paid something, and others will have to write off losses for debts that the bankrupt debtors will not repay. In both instances, the "forgiven" or "canceled" debt will not be repaid. By anyone.

Biden is neither "canceling" nor "forgiving" debts; he is transferring those debts to other people who never entered into those contracts, never borrowed or promised to repay the money, and never received the benefits (such as they were) that the borrowers purportedly did. But they will be forced to repay other people's debts in the form of higher taxes.

Biden calls this "debt cancellation" or "debt forgiveness," and the media goes along with it because it sounds nice. Ply the public's emotions with sad stories of people saddled with tens or hundreds of thousands of dollars in student loan debt, and then announce, "I am forgiving those debts."

If Biden were actually telling banks that they were not going to receive the billions of dollars they are owed, they'd be screaming bloody murder. But they know he's passing these debts along to the American taxpayer. Now instead of suing delinquent borrowers, they can sit back and let the IRS do all the work.

Supporters love to point out that college tuition has outpaced inflation for decades. And it has. Tuition increased on average 180% just between 1980 and 2020. It has consistently risen at twice the inflation rate. The average college tuition has increased more than 400% since 1985. And at some private universities (like Harvard, for example), tuition and room and board have increased by much more -- in some cases, close to 1,000%.

One of the biggest factors contributing to these exploding costs was the push for widely available student loans. When families had to pay costs out of pocket, they were far less likely to choose colleges they could not afford. The advent of student loans distorted the market. Colleges and universities could increase tuition and fees and encourage families to borrow the money and repay it later. But that means principal plus interest, and there is no guarantee a degree obtained with debt will produce income sufficient to repay it. Nor are most 18-year-olds thinking about the other expenses they'll have later: car payments, rent, a mortgage, utilities, and children.

Biden's loan "forgiveness" is this kind of wrongheaded policy on steroids. Colleges will be incentivized to increase costs if they know the government is passing those costs along to taxpayers. Ask yourself: What cars would people purchase if they were told the government would pay for the loan? What would happen if the government announced that taxpayers would be forced to pay everyone's grocery bills?

Biden's student loan policies are inflating a bubble. And bubbles burst.

Americans need to stop being swayed by politicians' protestations about their good intentions and start looking at the results of flawed policies. If we do not, we are just as culpable for the inevitable disasters those policies produce.

Join the conversation as a VIP Member