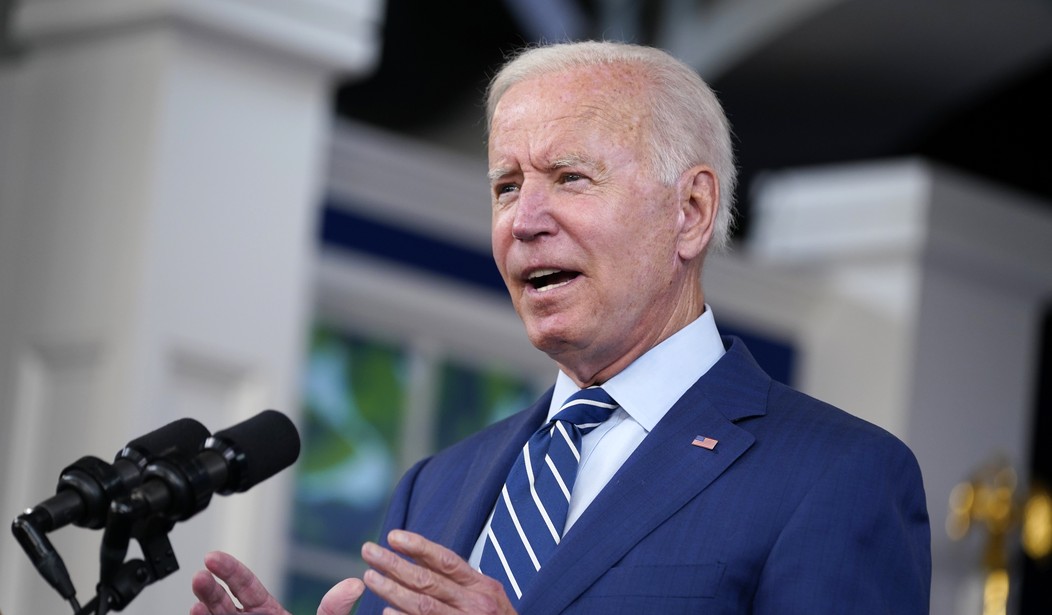

Last Saturday, President Joe Biden tweeted the following about his $3.5 trillion proposal: "My Build Back Better Agenda costs zero dollars. Instead of wasting money on tax breaks, loopholes and tax evasion for big corporations and the wealthy, we can make a once-in-a-generation investment in working America. And it adds zero dollars to the national debt.

There are several obvious flaws with the statement. The first is the underlying misunderstanding of how government expenditures work; the second a clear misunderstanding of how math itself works.

Let's start with the first: the concept of government taxing and government spending. Government does not create its revenue by providing a service or good for customers who may or may not purchase, depending on whether they want to buy the good or service at the price offered. Instead, governmental entities pass laws that impose taxes upon people.

It's not only the federal government that levies taxes, but also states, counties and cities. They levy taxes on what you earn, what you buy and what you own.

Social Security taxes, Medicare taxes, estate taxes, inheritance taxes, taxes on the transfer of property, property taxes for owning physical assets, fuel taxes, gas taxes and who knows how many other taxes. Since the government takes the income tax out of the employees' checks before they receive their pay, and the sales taxes are remitted by the seller, we often become numb to the high level of taxation.

The government then spends this money; for the past few decades, it has then borrowed more to cover the deficit that has resulted from spending more than we get in tax revenues. The only time we had a balanced federal budget in my lifetime -- and I was born in 1966 -- was when my dad, Newt Gingrich, was speaker of the House and cut a deal with then-President Bill Clinton.

Recommended

The Build Back Better bill Biden is touting is a $3.5 trillion social spending bill that is supposedly neutral because of the offsetting increases in tax payments that are also in the bill. Keep in mind that the government is also running a deficit, borrowing money to spend, which leads to inflation -- which lowers the purchasing power of every dollar. Think of it as a deficit tax.

"Democrats and the White House have proposed paying for the spending bill through an IRS crackdown involving ramped-up audits of American taxpayers and by raising taxes on higher incomes and businesses, such as raising the corporate tax rate from 21% to 26.5%, hiking the capital gains tax rate from 20% to 25%, and increasing the top individual income tax rate from 37% to 39.6%," according to a New York post article, "Biden hit for claiming Build Back Better agenda 'costs zero dollars'" written by political reporter Callie Patteson and published on Monday,

The sales pitch is clear to the public: "We want to give you someone else's money, those bad people who are keeping too much of their own money. The government needs more of it so we can then give it to you."

The math approach reminds me of a YouTube video that was circulated among my book club a few years ago: "Shopping Math is The New Free!" by Laura Zigman. The video highlights a discussion between an animated bunny woman figure and a dog man figure. He starts by asking her if she is wearing a new sweater.

"Yes, I got it on sale," she says. "It was originally 300 dollars, but it was 20% off. Which made it 240 dollars ... Which meant I could get these boots."

"Really," he replies.

"They were originally 800 dollars," she explains, "but they were 30% off, so they were only 560 dollars."

"Really," he replies.

"And they ended up being only 500 dollars," she notes.

"How?" he questions.

"I used the 60 dollars I made on the sweater," she counters.

"But you didn't make 60 dollars," he contends, "You saved 60 dollars by spending 240 dollars."

She disagrees. "That's not what I got."

"Obviously," he replies.

"Anyway," she continues, "with the 60 dollars I made on the sweater and the 240 dollars I made on the boots I got these jeans."

"Really," he says.

"They were 250 dollars, but with the 300 dollars I made, they were free," she says.

"Really," he says, "so according to your math you made 350 dollars today,"

"Right," she agrees.

"Your math is all wrong," he contends.

"No, it's not," she disagrees.

"You spent money today, you didn't earn money today," he exclaims.

"In your opinion," she replies.

"Math isn't an opinion," he said. "it's a fact."

"In your opinion," she replies.

"Besides, shopping math is different from regular math," she contends.

"How?" he asks.

"It's easier," she said, "and more fun."

The problem with shopping math, like political math, is -- while it may be more fun -- it's not real, and eventually we will run out of spending someone else's money.

Join the conversation as a VIP Member