Editor's note: This piece was co-authored by Maroun Medlej

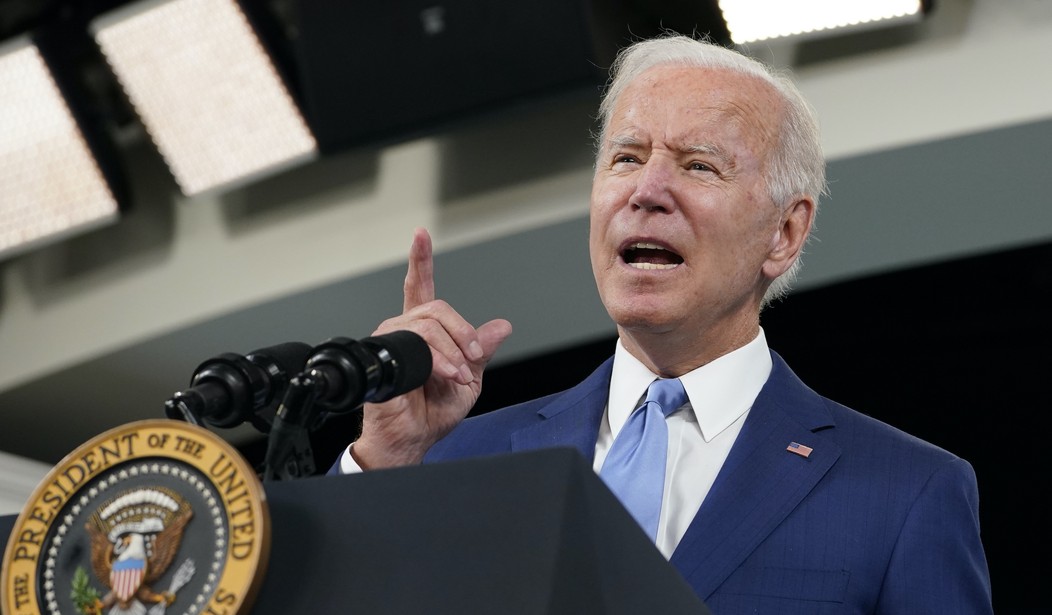

In early May President Biden proposed several tax increases, but stated that those who make under $400,000 per year "will not pay a single penny in taxes." And he has repeated that claim as he tries to get his legislation passed. Of course, he did not mean they would pay no taxes, just that they would not pay increased taxes under his program. He’s going to tax the rich and corporations. It’s a great sales pitch—corporations should pay their fair share and you ordinary folks won’t feel a thing. Unfortunately, it is just not true.

The plan to raise the corporate income taxes is blind to the fact that corporations are only legal entities. They actually serve as tax collectors for the federal government. Biden proposes to raise the current rate seven points, to 28 percent, a whopping 33 percent increase. House Democrats have reduced that grab to 26.5 percent, but the impacts would be similarly negative. If your taxes were raised that much, you would of course be forced to make adjustments, like less saving, fewer vacations, different consumption patterns. Corporations will do the same. And who really pays the corporate income tax? The answer is simple — almost everyone. How?

First, higher corporate taxes mean reduced net corporate income. When companies have lower after-tax income, their stock prices tend to weaken. Since more than fifty percent of U.S. households own equities, either directly or through pension plans, falling stock prices reduce household wealth. Second, with less after-tax income, corporate adjustments are likely to include dividend reductions, another ‘hit’ on the average American.

Third, reduced corporate retained earnings may be reflected in lower wages (from what they could be) for their employees. According to one study, the “ultimate effect of Biden’s campaign-promised tax increases would be real wages and real incomes that are 3 percent to 4 percent lower.” A European analysis found that for each additional Euro raised via corporate taxes wages would fall by 65 cents. Further, lower retained earnings are likely to reduce corporate investment, a critical backbone of the economy as well as an important source of productivity gains. Fifth, new jobs in the construction and producer durables sectors, which in part depend upon business investment, will also suffer. Sixth, such taxes are likely to lead to employee layoffs. Seventh, higher corporate taxes place our exporting businesses at a meaningful disadvantage in international competition. This too is likely to further reduce corporate income, equity prices, employment levels, and wages. Further, it is likely to drive some corporations to shift profits overseas. Finally, to the degree that they can, businesses will compensate by raising their prices, thus reducing the real wage of those purchasing their products. It also merits note that a 28 percent federal rate coupled with state taxes would lift our combined corporate rate to 32+ percent, very significantly higher than the global average of 23.79%.

Recommended

Of course, the exact magnitudes of the damage are very hard to calculate. Measurement depends on estimates of a wide number of variables, such as elasticities, capital mobility, and other hard-to-explain, but important economic assumptions. The Tax Policy Center maintains that a tax such as this will reduce investment in almost all sectors of the economy. It also estimates a loss of one million jobs in the first two years. Additionally, it finds that returns to investment — dividends, interest, and capital gains — bear 80 percent of the damage, with wages bearing 20 percent. However, a German study concluded that 51 percent of the burden fell on German workers.It also found that the wages for low skilled employees, women, and young workers were particularly reduced. According to the U.S. Chamber of Commerce, most analyses suggest that labor likely bears about 70% of the burden of the corporate income tax. And another study concluded that for every extra dollar collected via the corporate tax, an additional dollar and a half of economic resources are lost, clearly a losing proposition.

Such estimates clearly differ in the relative magnitude of impacts calculated and will continue to do so in the future. One thing, however, is clear-- the idea that corporations are paying the taxes and the rest of us get off ‘Scott free’ is a myth. Ironically, the alleged need for higher corporate taxation is to hold the budget deficit down, but with a slower economy these tax revenues are likely to fall, the exact opposite of the program’s intentions!

Maroun Medlej is a teaching assistant professor of finance at the George Washington University School of Business (GWSB). He is experienced in U.S. and international management and advisory in the areas of finance, budgeting, mergers and acquisitions, risk assessment, banking, and investments.

Join the conversation as a VIP Member