Pennsylvania’s general fund coffers took a major hit because of the coronavirus pandemic lockdown. But the full scope might not be evident until next year and state government must take serious steps to facilitate recovery, concludes a new analysis by the Allegheny Institute for Public Policy.

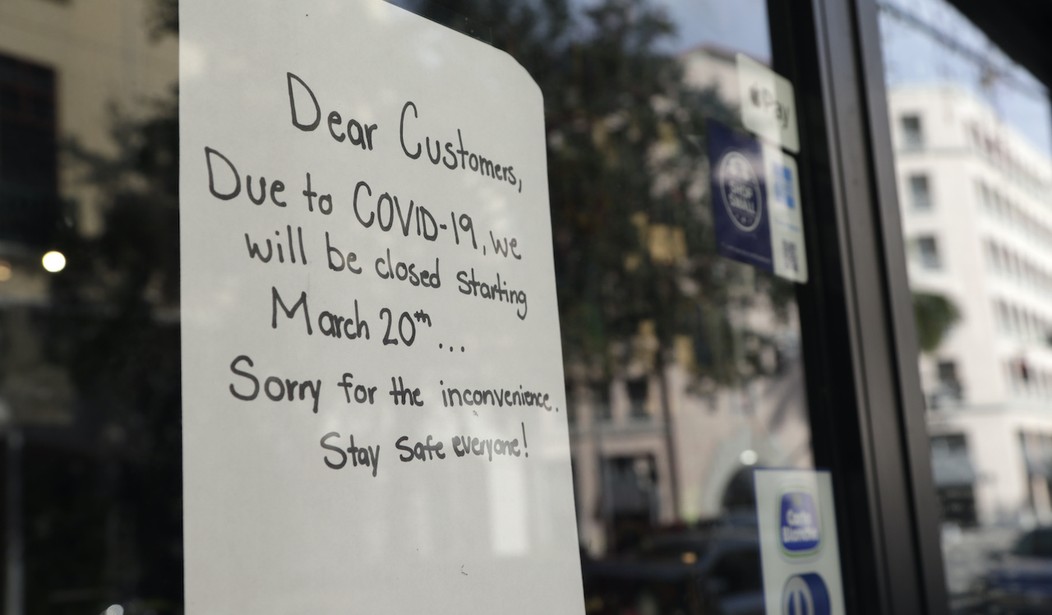

“The pandemic of 2020 will leave lasting economic scars as the shutdown forced many businesses to close, resulting in the furloughing of more than a million Pennsylvania workers,” say Frank Gamrat, executive director of the Pittsburgh think tank, and Jake Haulk, its president-emeritus (in Policy Brief Vol. 20, No. 21).

Data from the state Department of Revenue shows May 2020 total general fund revenue was $2.1 billion—about 20 percent less than May 2019’s $2.6 billion. May, however, is not typically a strong revenue month; April and March are typically the strongest revenue months for the commonwealth.

“In March 2020, when the shutdown only affected the last week or so, total general fund revenues were only down 2.6 percent from last March,” Gamrat and Haulk note.

“In April 2020 that amount was $2.2 billion or 50.6 percent below that of the same month a year ago. Over the three-month stretch of March through May, general fund revenues are down about $2.87 billion over 2019’s level for the same period.”

That said, January/February 2020 collections were better than 2019’s by about $312 million, so the overall loss for the first five months of 2020 is roughly $2.55 billion.

Recommended

“The damage to general fund revenues may not be as severe this year as it may be for next as income tax collections based on this year’s incomes will be much lower in the next fiscal year,” reminds Gamrat and Haulk, Ph.D. economists.

Personal income and corporate net income tax collections in 2020, based on 2019 incomes, should see a significant pickup as the extended July 15 filing deadline approaches.

“But it’s unlikely the sales and use tax revenues will return to last year’s level and much of the loss will take years to make up,” the scholars say. “The same holds true for some of the so-called ‘minor’ tax collections.”

A large share of lost sales and use tax revenue will be unrecoverable this year as it is unlikely consumers will increase spending enough beyond normal levels to make up the loss.

“Although the federal government has flooded the economy with enough stimulus money to do so and savings have piled up for many who were able to retain their paychecks,” Gamrat and Haulk say. “Many consumers may still be reluctant to venture out amid the ongoing uncertainty.”

Thus, hard decisions will have to be made with the upcoming budget (to replace an interim spending blueprint that expires in November), especially considering it remains unknown how much federal funding will be forthcoming for state and local governments.

“Now is the time for the state to look at changing the way it operates—to cut unnecessary spending and reduce personnel counts, to lower tax rates and reduce regulations to help businesses get back on their feet and encourage them to add employees to their payrolls,” Gamrat and Haulk stress.

“Getting the state’s economy back up to speed should be a top priority.”

Join the conversation as a VIP Member