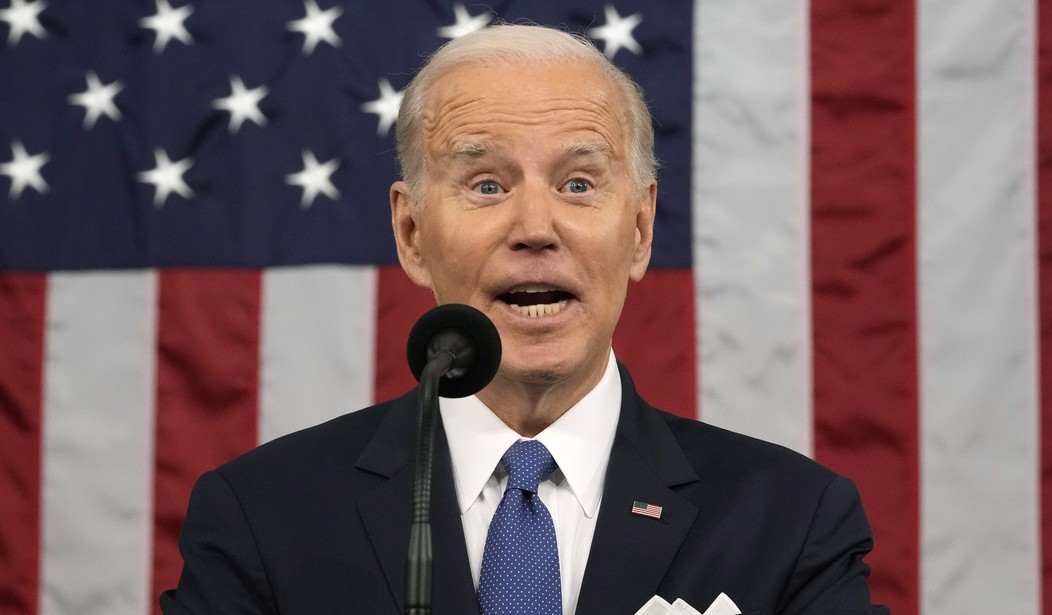

President Joe Biden has announced he will raise "some taxes" in the budget he is proposing this week to Congress. Biden again claims no one making less than $400,000 a year will pay more taxes.

The federal government receives record amounts of revenue, but spends and borrows in ways that add to the astronomical and unsustainable $31 trillion debt. As The Wall Street Journal noted in an editorial, "The Internal Revenue Service recently released its income and tax statistics for 2020 and they show the top 1 percent of earners paid 42.3 percent of the country's income taxes...a two-decade high in the share of taxes the 1 percent pay." The president repeats the false claim that "the rich" aren't paying their "fair share."

Sen. Joe Manchin, D-W.Va., is partially right when he says "You can't basically just tax your way out of debt. You can't borrow your way out of debt and you can't cut your way out of debt." In fact, you can cut the debt by spending and taxing less.

Let's start with improper payments made by federal agencies. According to reporting by The Washington Examiner, such payments totaled $175 billion just in 2019, as calculated by the government website PaymentAccuracy.gov. That's equivalent to $15 billion per month. This amount doesn't include the $2.25 trillion in taxpayer and borrowed money spent on improper payments, including millions sent to dead people. Auditors for OpenTheBooks.com discovered the most wasteful federal programs were Medicaid, Medicare and the Earned Income Tax Credit. In just these three programs, reports The Examiner, 69 percent, or $121 billion - were improper payments.

Recommended

Then there was the money wasted on COVID-19 relief, including the Paycheck Protection Program (PPP). NBC News reported "many who participated in what prosecutors are calling the largest fraud in U.S. history -- the theft of hundreds of billions of dollars in taxpayer money intended to help those harmed by the coronavirus pandemic -- couldn't resist purchasing luxury automobiles...mansions, private jet flights and swanky vacations."

They came into their riches, the network reported, "by participating in what experts say is the theft of as much as $80 billion -- or about 10 percent -- of the $800 billion handed out in...the PPP. That's on top of the $90 billion to $400 billion believed to have been stolen from the $900 billion COVID unemployment relief program -- at least half taken by international fraudsters...And another $80 billion potentially pilfered from a separate COVID disaster relief program."

There's more. During the pandemic, Congress approved more than $3.5 trillion in emergency funds that went to individuals and businesses. Of that amount, hundreds of billions reportedly were fraudulently paid out.

The Hill newspaper reported a few of many examples of fraud that should outrage members of Congress and might if they weren't spending other people's money. It cites eight people in Georgia who allegedly stole $30 million by filing unemployment claims for 5,000 people. Four people in Texas allegedly swindled $18 million in PPP loans and were trying to steal $17 million more.

The inspector general for the Department of Labor has reported that $163 billion of the $794 billion in Pandemic Unemployment Assistance was improperly paid out. Independent analyst, reports The Hill, have suggested that number could be closer to $400 billion with 70 percent leaving the country and lining the pockets of criminals from China, Nigeria and Russia, among others.

As the late Sen. Everett Dirksen, R-Ill., quipped "A billion here, a billion there and pretty soon you're talking about real money." Except today it's a trillion here and there.

Congressional Republicans have an obligation to taxpayers to uncover more fraud. They should also reform the main drivers of debt - Social Security, Medicare and Medicaid. Taxes need to be cut, not raised, to deprive the Washington beast of revenue they waste. Spending should be substantially reduced, bureaucratic, dysfunctional and unnecessary government agencies eliminated, and as much misspent money recovered as possible.

All of this should be an issue in next year's campaign.

Join the conversation as a VIP Member