Gold and silver rose in 2016, gaining 8.5% and 14.8%, respectively. The charts of the two metals for the year (see below) look like bell curves with prices rising in early 2016, hitting their peaks in the middle of the year and falling in the second half. Gold and silver shot out of the gate in 2016 as the stock market had its worse January ever following the Federal Reserve’s decision to raise interest rates for the first time in a decade in December 2015.

The stock market collapse in January 2016 caused the Fed to back away from its projected four rate hikes in 2016 and to cut it in half. As the year progressed, the stock market recovered from its January shellacking and gold and silver continued to gain. Silver and gold peaked in early July after the late June Brexit decision that sent both metals skyrocketing. Gold and silver held their gains through the summer and began to fall in the fall.

Gold and silver spiked briefly in the hours following Trump’s electoral victory in early November, but immediately sold off during the next six weeks. Gold and silver rebounded in the last week of trading of 2016 to finish with respectable gains.

Gold Demand in 2016

U.S. Mint gold sales of over 1.4 million ounces in 2016 were up 30% over sales in 2015. Gold sales at the US Mint were consistently elevated all year. Gold ETF holdings, in contrast, soared in the first six months of the year, then fell in the second half.

Gold demand in China and India, the two largest consumers of gold fell in 2016, partially due to higher prices and an Indian import duty of 10%. Gold demand as measured by withdrawals on the Shanghai Gold Exchange was down about 25% through November year over year.

Recommended

India, which imports nearly all of its gold demand as it has virtually no domestic mining production, saw imports fall more than 40% in 2016 from 2016. Gold imports spiked at year end due to the India government’s demonetization of 86% of the rupees in circulation, making gold an attractive alternative to a currency subject to the whims of the current Indian government.

The Central Bank of Russia, was the world’s largest central bank purchaser of gold in 2016, adding 196 tons of gold to her reserves through November, or 70% more gold than the second largest central bank purchaser, the People’s Bank of China.

Silver Demand in 2016

U.S. mint silver sales were down 20% in 2016 from a record 47,000,000 ounces sold in 2015, as higher prices cut into sales. Silver sales in the first half of the year at the U.S. Mint were on pace to exceed 2015’s record sales but fell sharply in the second half of the year.

Indian silver imports were down over 50% year over year through the end of October, mostly due to higher prices. At one point in 2016, the price of silver hit $20.47 an ounce in mid July or an increase of nearly 50% from January 1, 2016. India imported nearly 33% of the global silver mining production in 2015.

While precious metals shone in 2016, oil outperformed them with a % gain in 2016. Oil rose from multi-year lows, mostly on promises of oil output cuts, that have yet to materialize.

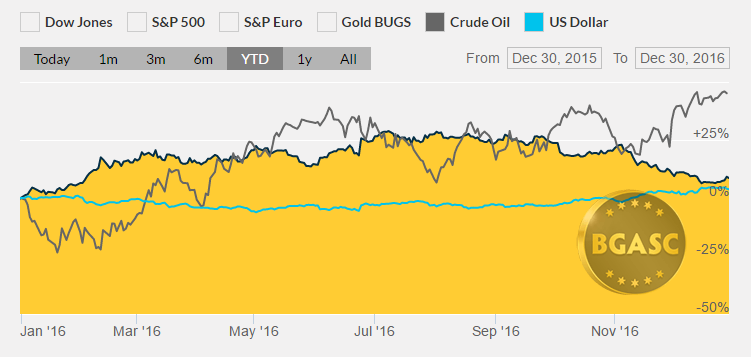

2016 Dollar Index, Oil and Gold Prices

Gold ended 2016 at $1150 an ounce up from $1060 an ounce on December 30, 2015, a gain of 8.5%.

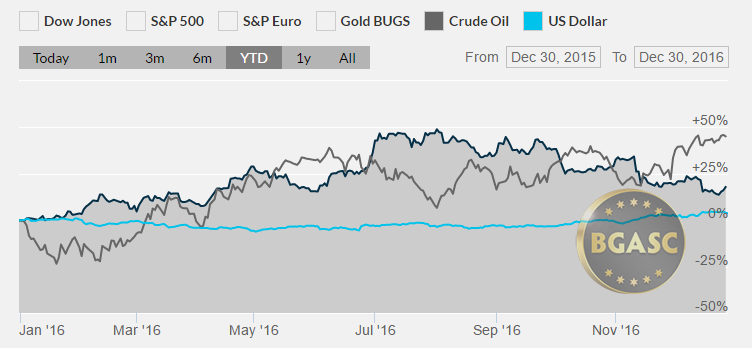

2016 Dollar Index, Oil and Silver Prices

Silver ended 2016 at $15.88 an ounce up from $13.83 an ounce on December 30 2016, a gain of 14.8%.

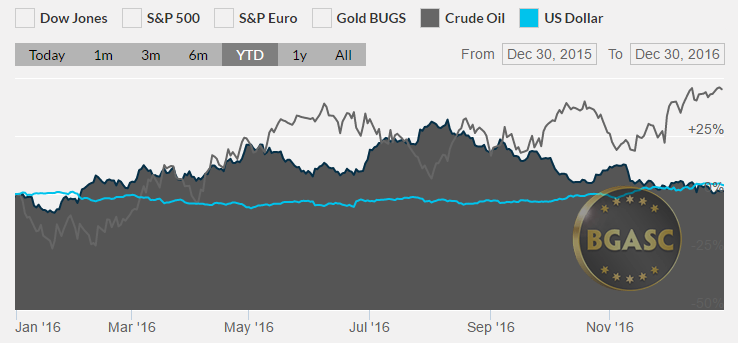

2016 Dollar Index, Oil and Platinum Prices

Platinum ended 2016 at $898 an ounce up from $868 an ounce on December 30 2016, a gain of 3.5%.

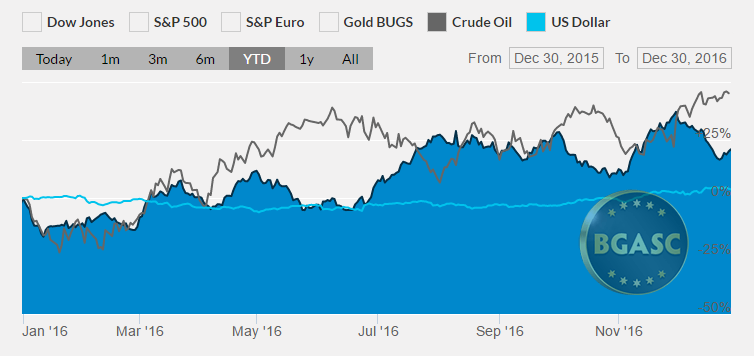

2016 Dollar Index, Oil and Palladium Prices

Palladium ended 2016 at $670 an ounce up from $555 an ounce on December 30 2016, a gain of 20.7%. Palladium was the best performing precious metal in 2016.

What’s next for gold and silver?

Many Wall Street analysts are predicting further gains for precious metals in 2017 as the uncertainty engendered by a new Trump administration should drive safe haven gold demand. In addition, President- Elect Trump’s proposed infrastructure spending, fueled by increased deficit spending, is expected to bring additional price inflation, which is also expected to benefit precious metals as they are viewed as effective inflation hedges.

Precious metals analysts will monitor Fed statements and actions closely in 2017 to see if the Fed stays on a gradual rate hike trajectory in 2017. After raising rates a quarter of a percentage point in December 2016, the Fed projected that it would raise interest rates four times in 2017. Any negative deviation from that schedule may also boost the prices of precious metals.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.

Join the conversation as a VIP Member